WHATS NEW?

Good Morning, Good Evening, and Goodnight,

Welcome back to another market update, in this journal I’m going to talk about the supply chain events in a retrospect of this month and a start to the New Year. The sole purpose for me to do this is to spark a conversation with you in the future and maybe gain perspective of your thoughts and strategies.

“A journey of a thousand miles begins with a single step. -Lao Tzu”

In this journal I’m going to Daiiv into supply chain updates, market insights, and innovations. This is the first Journal for 2024!

(My close network gets PDF journals as soon as they are written, if you would like to be a part of that thread find the best way to connect with me through my website!)

Warning: Market talk ahead. This is not financial advice; most investments carry a risk of losing some or all of the invested capital.

START OF THE YEAR SUPPLY CHAIN UPDATE

PMI: From Stagnation to Springing Back? The Manufacturing PMI increased from 47.9 in December to 50.3 in January. This indicates a shift from contraction to expansion in the manufacturing sector. This could signal renewed optimism for domestic manufacturing.

Crude Calm Amidst Global Turmoil: WTI Crude oil prices have been fluctuating and averaging around $76.55 per barrel. This could potentially impact inflation and pose challenges to businesses and consumers, which may affect the PMI’s trajectory. It’s crucial to monitor how geopolitical events will change the price of oil. Due to Yemen Houthi rebels escalating Red Sea tensions, Ocean Freight is taking longer than expected…

Tech Triumph: The tech revolution continues! We’re witnessing an explosive adoption of AI and machine learning, particularly in predictive analytics and dynamic route optimization. This tech-driven efficiency is yielding impressive results:

-

- UPS: Leveraging AI in their ORION system to anticipate shipment delays and reroutes deliveries, achieving a 15% reduction in transit times. (Fun fact: A UPS driver makes at least 130 stops a day.)

- Ford: Implementing AI-powered robots for precision assembly, boosting overall production speed by 20%.

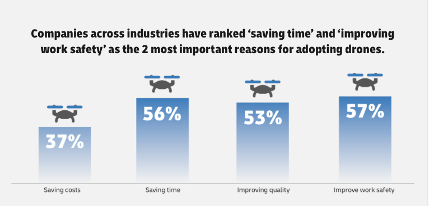

Automation: The robots aren’t just taking over factories – they’re infiltrating warehouses too! Amazon continues to lead warehouse automation, with their robotic fleet handling over 60% capacity in some of the warehouses. Drones are also taking flight, with companies like DHL experimenting with drone delivery for remote locations.

Blockchain: While the crypto market remains in flux, blockchain technology itself is quietly revolutionizing supply chain transparency and traceability. The government just approved Bitcoin ETF ($BITO, I am slowly adding shares, but this fits into my risk appetite). The potential benefits are wide-ranging, from reducing fraud and waste to streamlining customs clearance.

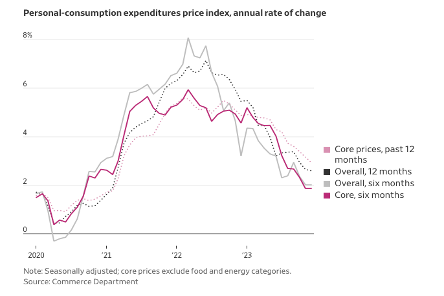

Inflation Rate: The annual inflation rate for the United States was 3.4% for the 12 months ending in December. This is above the Federal Reserve’s target of 2%.

-

- Year-over-year comparison: Compared to January 2023, the core CPI has decreased from 5.7% to 3.9%. (We are penciled in for rate cuts in March, but with current geopolitical tensions and high debt this may get extended till the summer.)

The Fed faces a delicate balancing act – fighting inflation without triggering a recession.

However, a ray of hope shines through amidst this uncertain environment:

-

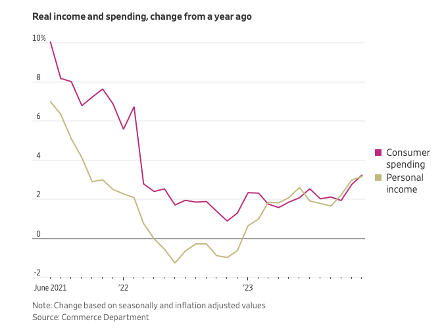

- Consumer confidence: Despite inflationary pressures, consumer confidence has shown signs of recovery in recent weeks, thanks to stabilizing gas prices and a strong labor market.

-

- Corporate resilience: Many businesses have adapted to the volatile environment by diversifying their supply chains, investing in automation, and focusing on operational efficiency. This proactive approach could provide them with a competitive edge in the coming months.

I am still holding short term treasury bonds; this is the best way to park cash while getting an interest of 5.17%. My risk appetite for this market has slowly increased but will remain cautious in this ever-changing economic landscape.

The SPX made 5-year highs this month and may pull back for a healthy correction for higher highs, but it is still a coin flip to predict which way the market can swing, this is based on many factors and the FED’s fight for inflation. (If we can see the SPX reach 5000 this year this may bring a wave of new investors that will be more optimistic for the year 2024. Bears on the other hand have gone into hibernation!! And for a spectator they may soon get FOMO…)

In conclusion, 2024’s supply chain landscape promises to be dynamic and challenging. While uncertainties remain, the rise of automation, AI, and blockchain technology, coupled with adaptable businesses and cautious optimism, offers a glimmer of hope for navigating the road ahead.

Written By:

-DAIVIK SURESH-

Sources

4 responses to “JANUARY 2024”

Great writeup! Keep up the good work

This is a good comprehensive read and get. Good overview of the market

Greatly written, really puts into perspective the shifts going on in 2024. It is great to see the advances that AI is bringing to the supply chain industry!

Very informative,

Daivik please check your email as I have a few insights to share and would like your opinion