WHATS NEW?!

Good Morning, Good Evening, and Goodnight,

Welcome back to another market update, in this journal I’m going to talk about the supply chain events in a retrospect of this month. June’s journal will be focused on supply chain innovations. The sole purpose for me to do this is to spark a conversation with you in the future and maybe gain perspective of your thoughts and strategies.

“Money moves from those who do not manage it to those who do”-Dave Ramsey

In this journal I’m going to Daiiv into supply chain updates, market insights, and more into innovations. This is the seventh journal for 2024 and I’m excited to share that all my journals are published on my personal website: Daiviksuresh.com

A direct link to all my journals is here: CLICK ME!

(My close network gets PDF journals as soon as they are written, if you would like to be a part of that thread find the best way to connect with me through my website!)

Warning: Market talk ahead. This is not financial advice; most investments carry a risk of losing some or all of the invested capital.

Maritime Cargo Trends

The Port of Los Angeles, one of the busiest seaports in the United States, has recently significantly upgraded its Port Optimizer system—this 8 Million dollar grant from the state. The system was launched in 2017 and it holds maritime shipping data for cargo owners and supply chain stakeholders. With this upgrade, the system will have predictive analytics which will be able to better anticipate bottlenecks and optimize resource allocation. The grant will focus on 3 main areas:

Truck appointment system-Make it easier to manage & move containers

California ports mobile application– New mobile app and better User interface.

Carbon impact gateway-This is the most important, because we can’t forget that supply chain and sustainability go hand in hand. Provide real time ‘Green Asset Scores’ based on emissions from rail, trucking, vessels, and port equipment.

I am quite excited to see how this will positively impact business as volumes are returning to pre-pandemic levels!

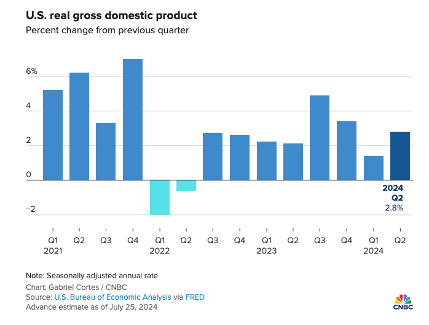

Labor Market & GDP Growth

Job openings dipped again in June and the number of people quitting fell to a 4-year low (8.23m in May||8.18 in July). Despite robust GDP(Gross domestic product measure of all goods and services produced) growth, prices have been higher for longer, personal consumption rose, but personal savings continue to decelerate.

Rate cuts and Election season

We are 4 months before elections and stepping into the second half of the year there are potential talks of rate cuts. While the Federal Reserve uses rate cuts as a tool to manage the economy, the FED may lower rates to encourage borrowing, spending, and investment. The Fed has kept the federal funds rate at 5.25% to 5.5% since July 2023. Historically stock markets don’t do well and weaken the bond market. As of July 31st, 2024, the Fed decided to leave rates and may seriously act on cutting in September. Two scenarios would push the Fed to cut: more good inflation data or a sudden worsening in economic conditions. I do believe we may have at least one rate cut this year but anything more could send the markets crashing. Sector rotation will happen from large cap to small cap stocks, and this will make borrowing easier for the Russel index.

Now being unbiased on the who the 47th President may be, whoever wins will also dictate how the economy will perform and key industries/markets that will flourish.

TRUMP

- Favor domestic energy pumping out more oil, national gas, and coal.

- Cryptocurrency may become more popular thus increasing the price of major coins.

- Decrease dependency on technology from foreign companies.

- Largest deportation of illegal immigrants

- Decrease corporate tax.

KAMILLA

- Favor clean energy and renewable energy, continue the Biden reduction act.

- Continue relations and trade with international companies

- Open border, encouraging more people into the country.

- Focus on smaller business, women, and middle-class families

- Increase corporate tax

Then again there is much that both parties can contribute and will help the economy grow. Regardless of who wins, I am optimistic that the country will grow and our portfolios as well!

If you would like to contact me, please navigate through my website, and find the best way to connect!

Sources

Job Data July 2024

GDP Q2 2024

Kamilla

Port of Los Angles

Trump

Written By:

-DAIVIK SURESH-