WHATS NEW?

Good Morning, Good Evening, and Goodnight,

Welcome back to another market update, in this journal I’m going to talk about the supply chain events in a retrospect of this month. The sole purpose for me to do this is to spark a conversation with you in the future and maybe gain perspective of your thoughts and strategies.

“Money can’t buy happiness, but it will certainly get you a better class of memories.” – Ronald Reagan

In this journal I’m going to Daiiv into supply chain updates, market insights, and more into innovations. This is the second journal for 2024 and is a much quicker read. A direct link to all my journals is here: CLICK ME!

(My close network gets PDF journals as soon as they are written, if you would like to be a part of that thread find the best way to connect with me through my website!)

Warning: Market talk ahead. This is not financial advice; most investments carry a risk of losing some or all of the invested capital.

Springing Forward, But Watch the Road Ahead

Crude Calm Amidst Global Turmoil: The calm hasn’t quite arrived. Oil prices have recently climbed to almost $80 per barrel, fueled by the ongoing Ukraine crisis and potential disruptions in the Red Sea due to Yemeni Houthi activity. This could exacerbate inflation concerns and impact businesses across the board… (I mentioned in my last journal that prices will go back up, if you bought oil you should be in the green for now. Bullish on $APA & WTI crude)

Emerging Technologies:

- 3D Printing and On-Demand Manufacturing: 3D printing, also known as additive manufacturing, is transforming traditional supply chains by enabling on-demand production closer to the point of use. This technology significantly reduces the need for inventory and logistics, simplifying supply chains, and potentially reducing carbon footprints. It allows for the production of parts from a digital file, reducing the need to transport physical goods across countries and continents, which has major impacts on warehousing and logistics.

- Self-Driving Trucks and Autonomous Delivery Vehicles: Self-driving trucks, also known as autonomous trucks or robo-trucks, are an application of self-driving technology aiming to create trucks that can operate without human input. The trucking industry is well-positioned to reap the benefits of autonomous vehicle (AV) technology. AV technology has the potential to address safety issues, and it’s envisioned that a model where truck drivers and self-driving trucks connect long-haul and local-haul routes will support the growth in truck freight demand. California by 2028 will start to roll out EV trucks with AV capabilities.

Blockchain: While the crypto market remains in flux, blockchain technology itself is quietly revolutionizing supply chain transparency and traceability. The government just approved Bitcoin ETF ($BITO, I am still adding shares, but this fits into my risk appetite). The potential benefits are wide-ranging, from reducing fraud and waste to streamlining customs clearance and building stronger supplier relationships. Blockchain and digital twins are revolutionizing retail by offering secure document management, real-time inventory tracking, improved product traceability, and enhanced customer experiences through NFTs and virtual events. However, data privacy, system integration, and staff training need careful attention to fully unlock their potential.

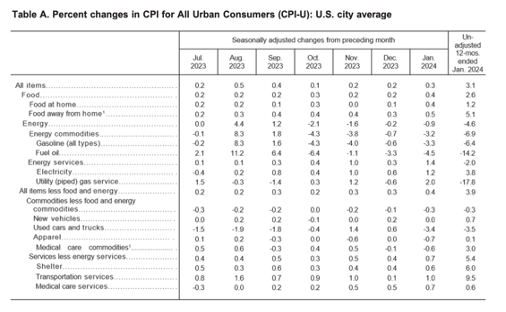

Inflation Rate: The annual inflation rate for the United States was 3.1% for the 12 months ending January. This is above the Federal Reserve’s target of 2%.

- Consumer confidence: Despite inflationary pressures, consumer confidence has shown signs of recovery in recent weeks, but the boat is starting to rock bath and forth. (Beware for MARCH since it has historically it has been CRASH month)

- Corporate resilience: Many businesses are still adapting to the volatile environment by diversifying their supply chains, investing in automation, and focusing on operational efficiency. This proactive approach could provide them with a competitive edge in the coming months.

My risk appetite for this market is starting to decrease, but will remain cautious in this ever-changing economic landscape. I will be putting my money in high dividend yields. As well as holding short term treasury bonds, this is the best way to park cash while getting an interest of 5.17%. SPX reached 5000+ this month and this may bring a wave of new investors that will be more optimistic for the year 2024. Bears on the other hand may come out of hibernation! And for a spectator they may soon get FOMO.

In conclusion, 2024’s supply chain landscape promises to be dynamic and challenging. While uncertainties remain, the rise of automation, AI, and blockchain technology, coupled with adaptable businesses and cautious optimism, offers a glimmer of hope for navigating the road ahead.

Sources

Written By:

-DAIVIK SURESH-

5 responses to “FEBRUARY 2024”

Very good articles

This is very informative, please talk more on Gen AI

Hey Daivik,

Love these Journals, Please keep them going!

Daivik,

Please see let me know if you can write more about Change in consumer spend. I believe these are informative and will share with my group.

Thanks

Great Journal!