April 2025

Good Morning, Good Evening, and Goodnight,

Welcome back to another market update, in this journal I’m going to talk about semiconductors in supply chain, along with how it is shaping the industry. The sole purpose for me to do this is to spark a conversation with you in the future and maybe gain perspective of your thoughts and strategies.

“Don’t Check Me, Check your Credit Score”-Larry June

In this journal I’m going to Daiiv into supply chain updates, market insights, and more into innovations. This is the fourth journal for 2025, and I’m excited to share that all my journals are published on my personal website: Daiviksuresh.com

A direct link to all my journals is here: CLICK ME!

Warning: Market talk ahead. This is not financial advice; most investments carry a risk of losing some or all of the invested capital.

Semiconductor

Semiconductors are the backbone of modern technology, powering everything from smartphones to cars and medical devices. This journal is going to explore the role of supply chains in the semiconductor industry, recent changes driven by policy and geopolitics, tariffs, the relocation of manufacturing facilities to the USA,

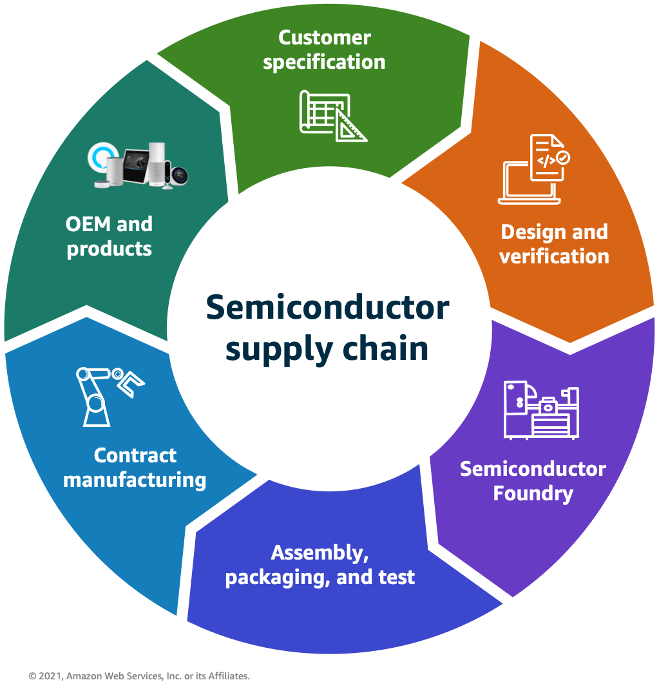

Supply chain Process for a Semiconductor

- Design: Engineers create chip blueprints

- Manufacturing: Specialized facilities (fabs) produce chips on silicon wafers, with Taiwan (e.g., TSMC) dominating advanced production.

- Packaging and Testing: Chips are encapsulated and tested for functionality, often in Asia.

- Distribution: Chips are shipped to customers or integrated into products worldwide.

Several factors have reshaped the semiconductor supply chain:

- Geopolitical Tensions: US-China trade disputes have highlighted risks of relying on foreign production, particularly from Taiwan, which produces over 60% of global chips.

- CHIPS Act: The 2022 CHIPS and Science Act provides $52 billion to boost US semiconductor manufacturing, reversing a 70% decline in US production share since 1990

- Reshoring Efforts: Companies are moving or planning facilities in the USA to enhance supply chain resilience and reduce dependency on Asia.

But what’s the catch

- Increased Costs: Tariffs on semiconductor manufacturing equipment and raw materials sourced from overseas directly increase the cost of production for US-based chipmakers.

- Supply Chain Disruptions: Tariffs can lead to delays, shortages, and the need for companies to find alternative sourcing, which can be time-consuming.

- Geopolitical Relations: Imposing tariffs on key players like Taiwan (TSMC) and South Korea (Samsung), which dominate global chip manufacturing, could strain diplomatic and trade relations with crucial allies. It might also incentivize the formation of non-US trade alliances, potentially isolating the US in the long run.

- High Costs: Building and operating semiconductor fabrication plants in the US is significantly more expensive than in Asia.

- Time to Build Capacity: Establishing new semiconductor manufacturing facilities is a long-term endeavor, often taking several years from planning to full production.

Since we will reduce reliance on foreign suppliers and foster more innovation, there is a light at the end of the tunnel, and this is a strategic plan will benefit the US in the long run. Not only will this create more jobs, but it will boost the GDP, and our country will foster more innovation. As our technological world will continue to use more chips, there will also be a reduced vulnerability to global disruptions. Below are some stocks I suggest buying as I see the future of semiconductors than more than just microdevices, but a commodity in constant circulation.

$AMD

$NVDA

$TSCM

$AVGO

If you would like to contact me, please navigate through my website, and find the best way to connect!

Sources

Supply chain diagram

Written By: Daivik Suresh